IDENTITY THEFT PREVENTION TIPS

Identity Theft Prevention Tips

There are six main steps that you as the victim should take upon discovering that you are a victim of an identity crime. These steps are as follows:

1) File a Police Report

As the victim, you are required to file a police report in order to dispute fraudulent transactions, correct compromised accounts, place fraud alerts with the credit bureaus and to obtain free copies of your credit reports to review. As the victim, you should obtain and retain a copy, receipt, or summary of the initial police report. The Laureldale Police Department will provide you with a report summary. You should be sure to maintain the original report summary provided to you by the Laureldale Police Department, but may make as many copies of it as needed. The report summary should be attached to each affidavit (described below). As the victim, you will need to send a copy of the police report summary to each involved bank, creditor, other business, credit bureau, and debt collector in order to dispute fraudulent accounts or transactions. As the victim, you should keep a detailed journal to record every corrective action, all names of companies or representatives to whom you speak or write to. An example of a journal can be found at http://www.identitytheftactionplan.com/

This sight also contains other pertinent information.

2) Obtain & complete an Identity Theft Affidavit for each compromised or fraudulently opened account.

As the victim you are required to prepare an affidavit stating you did not commit the fraud. A copy of an Identity Theft Affidavit that is accepted by most businesses, Creditors, and debt collectors, can be obtained at the Federal Trade Commission Website:

www.consumer.gov/idtheft/ is provided in appendix C. An example of this affidavit is attached to this package. As the victim, in order to dispute a fraudulent account or transaction, a copy of this affidavit must be coupled with a copy of the police report summary, and sent to every creditor, business, and debt collector through which a fraudulent account or transaction has occurred.

3) Close all accounts believed to have been compromised or opened fraudulently.

As the victim you should immediately contact the credit card companies, banking and other financial institutions, and close all accounts that have been compromised. You as the victim can work with your financial institutions to re-establish an alternate account to prevent further fraud.

4) Place a fraud alert with each credit bureau; obtain and review credit reports

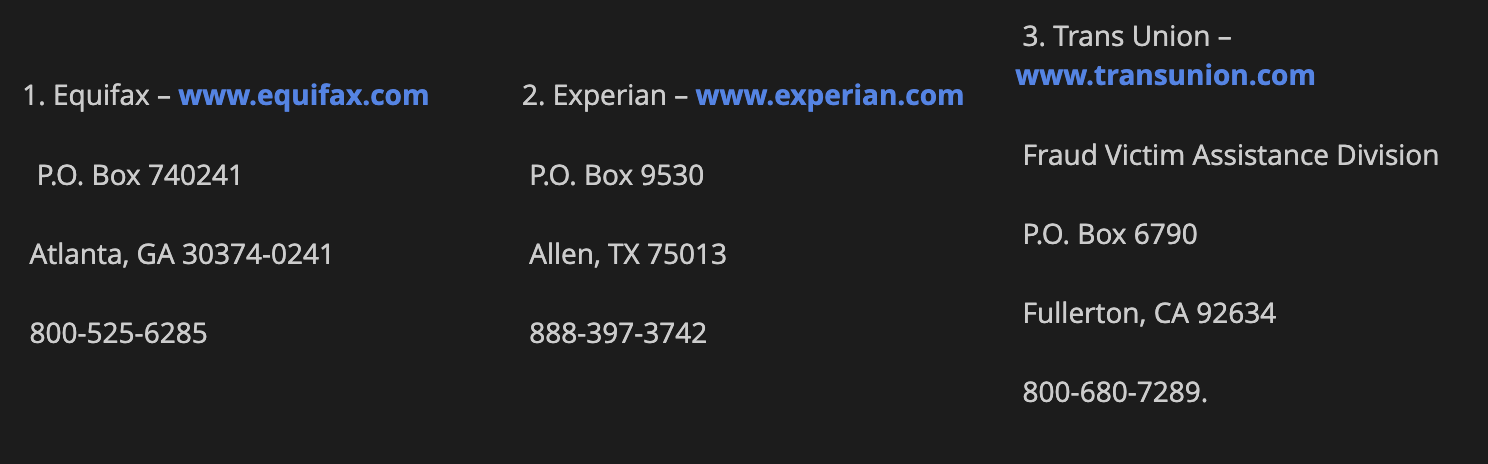

As the victim, you must contact at least one credit bureau to place a fraud alert. As the victim, you are entitled to receive one free credit report per year from each of the three credit bureaus so that you may attempt to identify new fraudulent activity. The free credit reports can be obtained through www.annualcreditreport.com. The three major credit bureaus are:

5) Fraud Alerts.

As the victim, you should place a fraud alert on your credit report in order to prevent the opening of additional fraudulent accounts and to flag additional fraudulent activity.

Federal law requires that when a fraud alert is reported to a credit bureau, that Credit bureau must inform the remaining credit bureaus of the fraud alert. However, in some instances the victim is required to contact the remaining credit bureaus in order to place the fraud alert.

6) File a complaint with the Federal Trade Commission

As the victim, you should file a complaint with the Federal Trade Commission Identity Theft Hotline at

1-877-438-4338 or on the internet at www.consumer.gov/idtheft . Also attached to the action plan is a copy of a letter sent to an institution by the victim requesting the release of specific information.

http://postalinspectors.uspis.gov/ Additional websites to assist the victim with information on identity theft: Pennsylvania Department of Revenue Website

http://www.revenue.pa.gov/GetAssistance/IDTheftProtectionAndVictimAssistance/Pages/Reporting%20ID%20Theft.aspx

HELP US KEEP OUR COMMUNITY SAFE - REPORT A CRIME TIP!

CONTACT US

Call 9-1-1 for emergencies and in-progress incidents.

Call (610) 929-8816 for incidents not in-progress.

ABOUT

JOIN OUR MONTHLY NEWSLETTER

Contact Us

We will get back to you as soon as possible.

Please try again later.